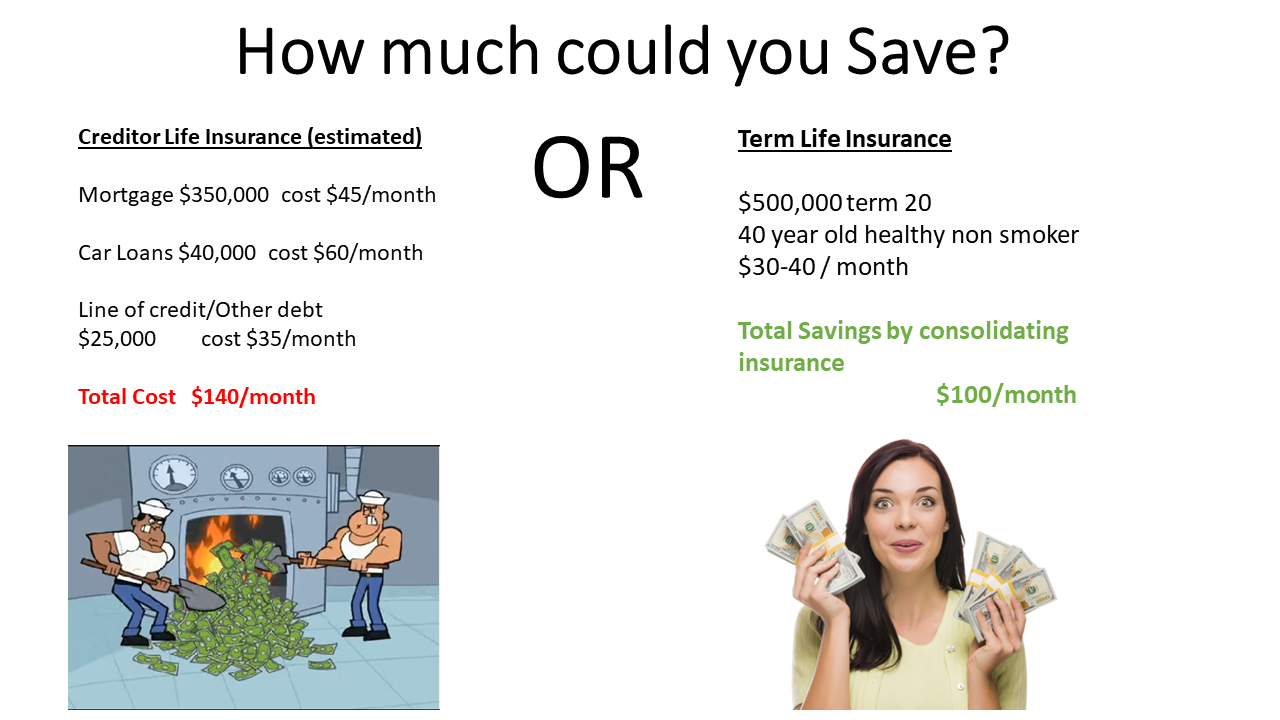

Building Wealth with Whole Life Insurance in Canada

Building Wealth with Whole Life Insurance in Canada Whole life insurance is more than just a financial safety net—it can be a powerful tool for wealth building. In Canada, many individuals use whole life insurance policies to grow assets, protect their estates, and create tax-efficient investment opportunities. Here’s how you can leverage whole life insurance … Read more