One of the most common requests when working with New Brunswick retirees is helping unlock their eligible pension amounts. This requires a calculation done online through FCNB to determine if you have ever previously done a pension unlocking and what the amount would be.

It is important to know that for NB pensions you are only allowed to do this process once in your lifetime so make sure when you do it you make it count. We recommend to do your pension unlocking as it converts locked in funds that have withdrawal limitations to unlocked registered funds that no longer do.

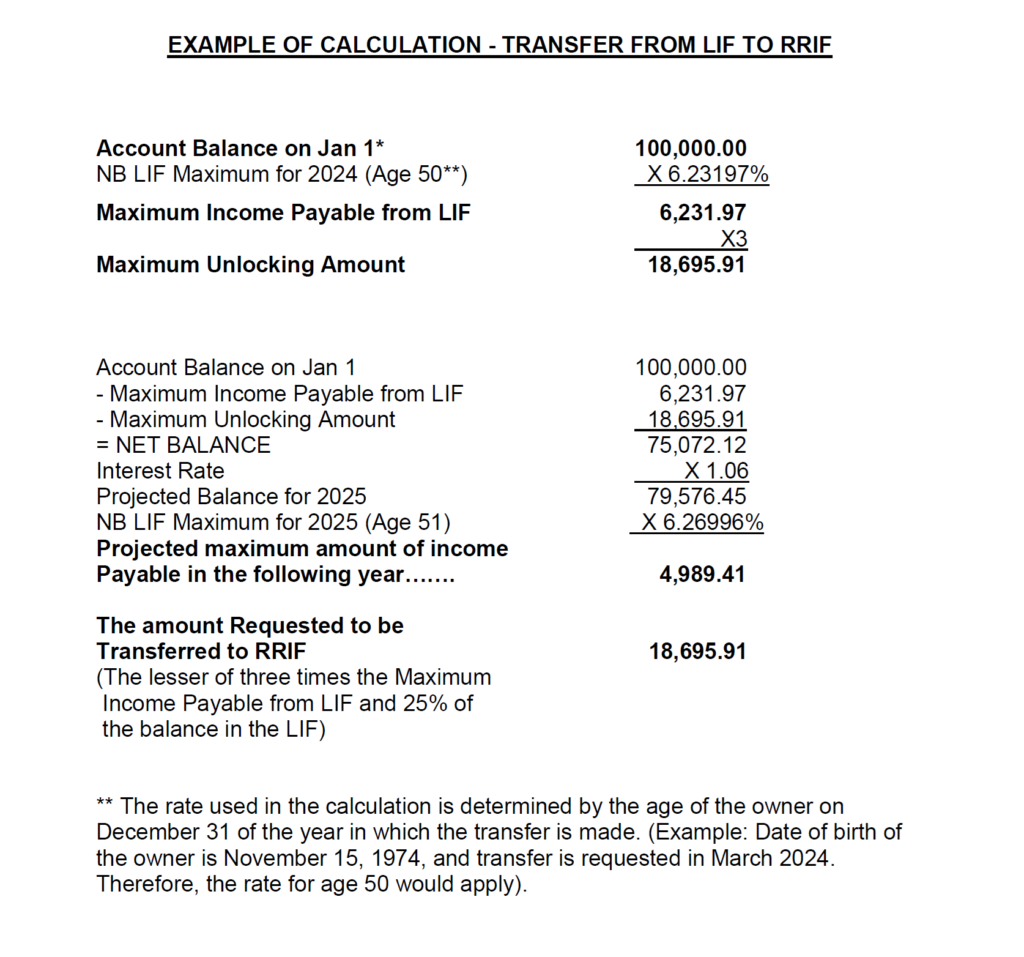

Here is a sample calculation taken from FCNB website for 2024 unlocking.

This is publicly available data available at: Pension Transfers and Withdrawals | New Brunswick Financial and Consumer Services Commission (FCNB)

The calculation may look complex but it is actually quite simple. It is basically 3 times the amount of your maximum annual Income payable for your age up to a limit of 25%.

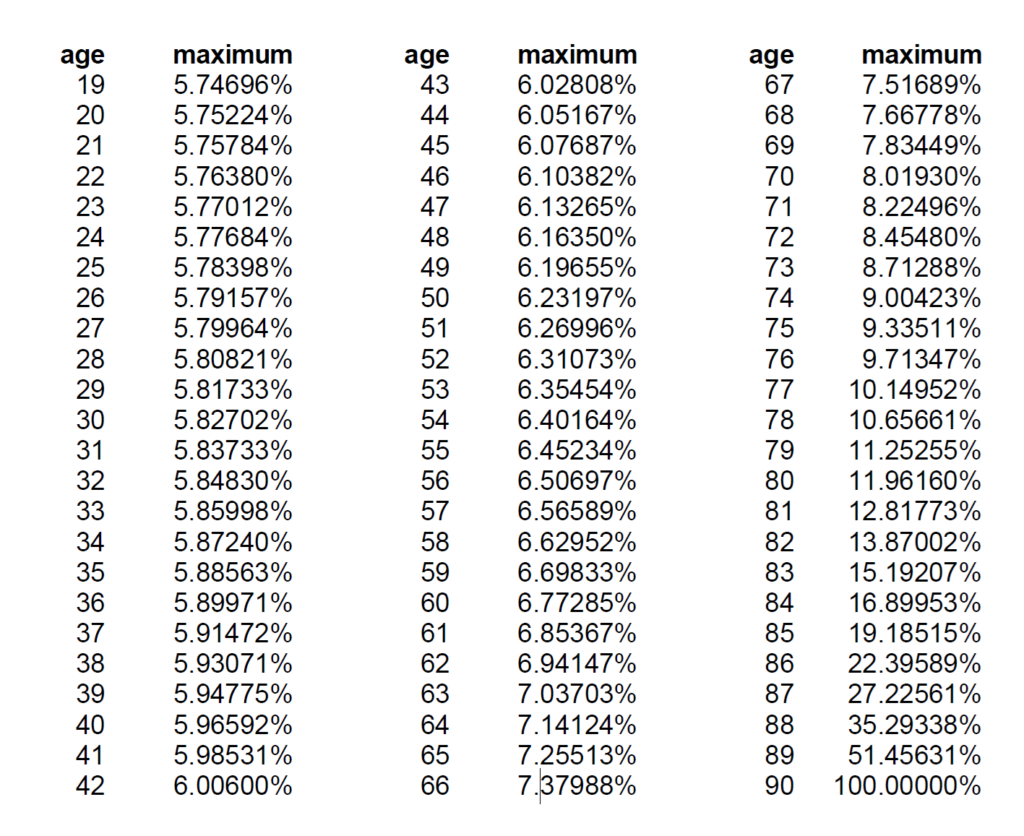

Here is the Lif Maximum withdrawal Table for 2024 that you would use to determine that amount:

As you can see the 25 % limit rule only comes into affect if you wait until age 72 to do your lif unlocking as 8.4548% x 3 = 25.3644%. It would then be reduced to 25%.

This Process also needs to be notarized or witnessed by a commissioner of oaths and it is highly recommended that you seek the advice of a financial advisor to help. We do these regularly for our clients and make it a seamless transition.

You can also review the FCNB website as highlighted above to ensure you understand the legalities of doing an unlocking. Especially if you are signing off as the spouse who would have beneficiary entitlement to the pension funds that are now being unlocked.

A summary of what pension unlocking is:

You are taking funds that are locked in that came from a defined contribution pension or Registered pension plan and are now in the form of a LIRA (Locked in Retirement Account) or LIF (Locked in Income Fund) and converting them to a RIF (Retirement income fund)(Not locked in).

If the funds are in a LIRA they must be first converted to LIF before doing an unlocking. They must be transferred to a RIF but then can be converted back to an RRSP (Registered Retirement Savings Plan) if you are not ready to start your income withdrawals.

It is important to note though during this process you will trigger at least one payout that will be required once you convert to a LIF. You must meet the LIF/RIF withdrawal Minimum even if you convert them back to LIRA and RSP. This is extremely important to be aware of as you may affect your tax situation or interfere with any subsidies or disability payments as the withdrawal will be added to your income.

We recommend working with someone who understands the complexities around New Brunswick pension unlocking. Please contact us if you would like to get in touch with an Advisor.

*This article has not been reviewed for errors and there is no guarantee of complete accuracy